Entrepreneurship has taken on great global significance for governments looking to boost growth and employment since the global financial crisis. It is also seen as a remedy for socio-economic challenges.

Entrepreneurship has taken on great global significance for governments looking to boost growth and employment since the global financial crisis. It is also seen as a remedy for socio-economic challenges.

It leaves no question as to why the local government has placed so much emphasis on the small and medium enterprise (SMEs) front here, as well as entrepreneurs to start formulating their companies — especially now.

According to a Standard Chartered report titled ‘Entrepreneurship – A growth tonic’, it is increasingly accepted that only opportunity entrepreneurs – those who start businesses to exploit an opportunity or fill important gaps in the market – are relevant for growth.

These opportunity entrepreneurs tend to usher in productivity improvements and innovative products or processes that support high growth, making operations more sustainable and allowing for easier transition to larger firms.

A common assumption is that opportunity entrepreneurs will largely be relatively new firms that are primarily related to the information technology (IT) sector. As a result there has been a focus on supporting start-ups and encouraging industrial clusters, as well as other entrepreneurial ventures in the high-tech sectors.

It is also assumed that venture capitalists or ‘angel’ investors rather than more traditional sources of finance usually support these firms.

Data on the characteristics of opportunity entrepreneurs and the constraints and challenges they face is very limited. To gain a better understanding of opportunity entrepreneurs, Standard Chartered conducted its own survey for the report.

Dependence on emerging markets

The global financial crisis has seen the world become more dependent upon emerging markets to drive global growth.

Following a boost from fiscal spending immediately after the crisis, emerging market authorities are increasingly looking to raise private-sector participation for sustained economic growth. Developing entrepreneurial capabilities domestically is a significant aspect of reform plans across major emerging markets noted the report.

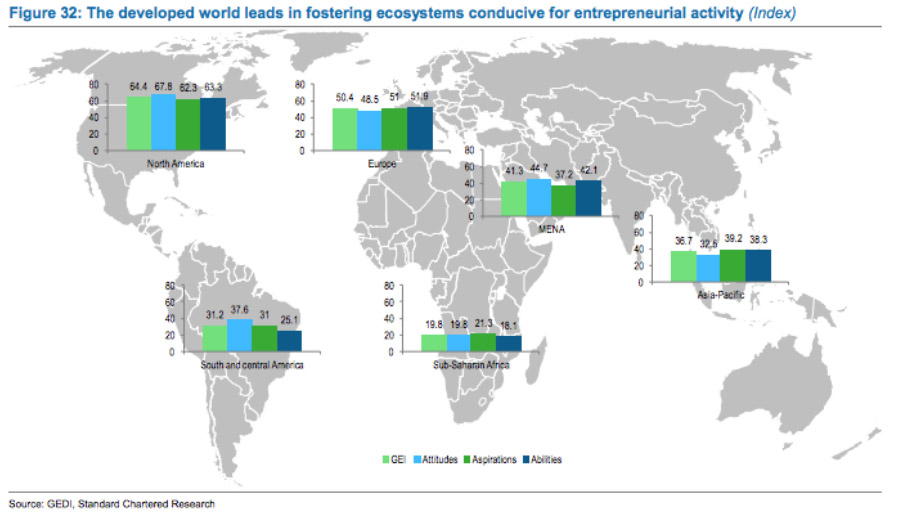

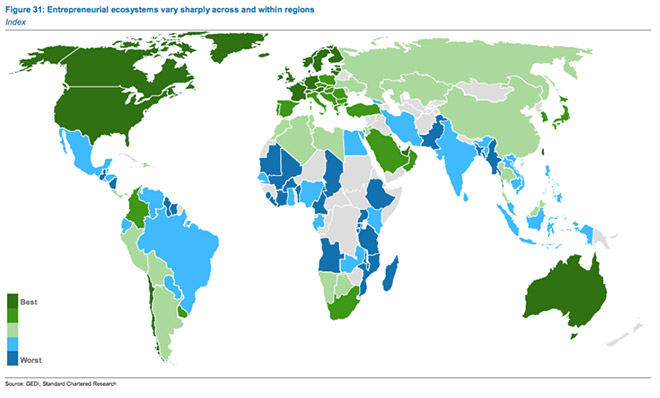

According to data from the World Bank, entrepreneurial activity is high and rising in the more developed markets, while it has been weak in emerging countries, with little sign of improvement over the last decade suggesting that the level of economic development is highly correlated with entrepreneurial activity in an economy.

However, a comprehensive survey of entrepreneurship at a global level is available in the Global Entrepreneurship Monitor (GEM) showed that countries such as Nigeria, Ghana, Chile, Cameroon and Thailand show the highest levels of entrepreneurial activity, ahead of more developed countries like the US, UK and Singapore by a wide margin.

At the same time, other emerging markets like India, Malaysia and Russia show very weak entrepreneurial activity proving no such clear relationship.

There are good reasons to believe that entrepreneurs usher in productivity growth and economic progress through the introduction of new products, processes or the tapping of new markets. Entrepreneurs can also play a key role in generating employment.

The answer lies in different types of entrepreneurship, based on the motivation driving entrepreneurial activity. Some entrepreneurial activity in almost all countries is driven by necessity and the lack of viable alternatives, in particular, other gainful employment.

These ‘subsistence’ entrepreneurs are only able to support themselves or their immediate families. This type of necessity or subsistence entrepreneurship has little impact on economic growth as these entrepreneurs are unlikely to innovate or employ people outside their immediate family.

On the other hand, ‘opportunity’ entrepreneurs start businesses because they identify new opportunities. Such businesses are more likely to expand into larger entities as these entrepreneurs are willing to continuously innovate and also are more likely to generate higher growth and greater employment opportunities.

The distinction between these two categories of entrepreneurs is critical. Recent academic work shows that not all-entrepreneurial activity is growth enhancing. It is only a higher ratio of opportunity entrepreneurs to subsistence entrepreneurs that is positively correlated with economic development.

As a result, a developing country such as Malaysia that has a preponderance of subsistence entrepreneurs will find it harder to escape the subsistence trap.

Looking at the bigger picture

Governments such as Malaysia’s, who is looking at entrepreneurship to boost economic growth need to focus on promoting opportunity entrepreneurship in particular, even though these entrepreneurs might form only a very small part of the total entrepreneurship pool.

“Most opportunity entrepreneurs are positioned at the smaller end of the SME segment, with the median number of employees for our respondent firms being 25. More than 60 per cent of these firms have also predominantly seen an average turnover over the last three years of circa US$3.25 million, placing them once again at the lower-end of the SME spectrum.

“GEM data indicates that innovation differs widely depending on the level of economic development. Innovation has high importance for opportunity entrepreneurs across regions.

“Not a single respondent believed that technology would affect their business negatively, with an overwhelming majority (80 per cent) expecting the impact to be positive,” noted the report.

The latest GEM survey, which looks at both necessity and opportunity entrepreneurs, supports this view. It shows that a majority of developed-world entrepreneurs are concentrated in the IT and services sectors.

But entrepreneurs in less developed economies are predominantly positioned in wholesale and retail trade. Data on the sectoral distribution of opportunity entrepreneurs is very limited.

For entrepreneurs and SMEs alike to flourish, there needs to be a conducive environment.

However, the environment is changing so fast, what may be considered conducive two years ago is already falling behind. So the key element now is that can the government assist them in the traditional manner despite the changing environment and can the SMEs themselves cope with the fast changing market.

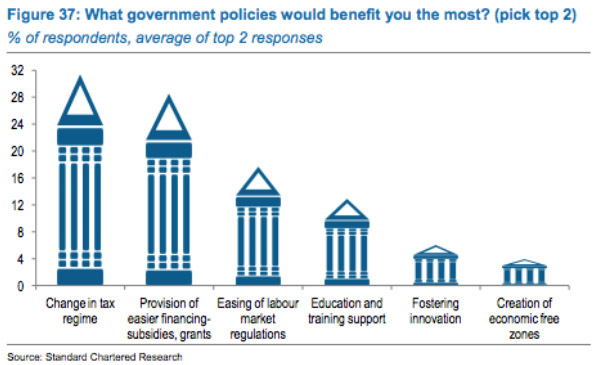

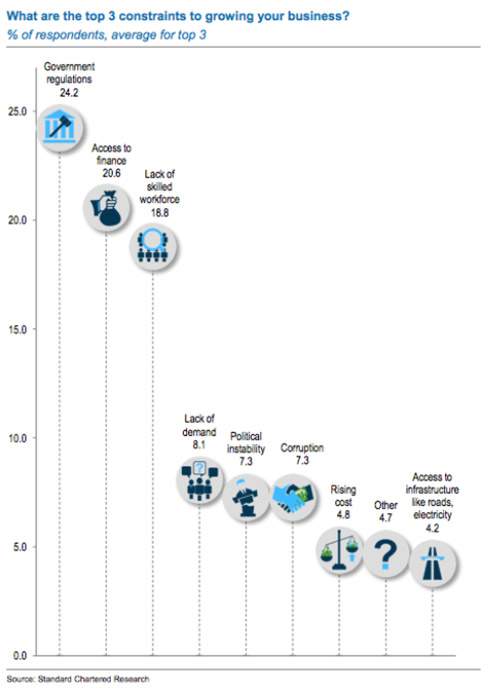

The survey shows that the main constraints that opportunity entrepreneurs face in growing their businesses come from government regulations; access to finance; and lack of a skilled workforce, irrespective of the country of residence.

Some respondents also indicated that weak global growth and lack of demand is a concern. While most respondents agreed that policy action was being taken to help entrepreneurs, they did not feel that this was effective or relevant.

The lack of finance options was reflected in the predominant use of own funds or those from family and friends to fund the business and evident in the high rate of re-investment of profits into the business.

Venture capital or angel investments are still a very small part of the finance mix, with bank finance being the other major source of finance for opportunity entrepreneurs.

Aside from that, the report noted that the focus is on developing a supportive entrepreneurial ecosystem based on several different pillars, including financial, cultural, educational and regulatory.

Government action crucial for SMEs

It is commonly believed that opportunity firms or high-growth enterprises are usually funded by venture capital but is shown to be relatively unimportant as a source of finance for opportunity entrepreneurs in markets according to the survey.

“Only around two per cent of respondents in our survey benefited from such sources of finance. Bank finance is a significant source of capital for opportunity entrepreneurs but a large majority rely on their own or family funds to start up and maintain businesses,” said Standard Chartered.

This is also reflected in the way in which profits from the enterprise are distributed among competing claims.

According to the survey, over 70 per cent of all profits are reinvested into the business, with the remaining pot largely being divided between paying down existing debt and remunerating employees in the form of bonuses.

Opportunity entrepreneurs’ commitment to growing their business is evident from the low levels of withdrawals as dividends.

The report highlighted that when asked, respondents noted that the top three constraints to business expansion were government regulations, access to finance and the lack of a skilled workforce.

Poor access to finance ties in with the reliance on own funds for starting a business and suggests that there is still scope for improving not only bank finance availability but also encouraging newer sources of funding, such as angel investors or crowd sourcing.

A few respondents also cited weak demand and a tough global macroeconomic environment as limiting factors to growth.

While arguments are made in the report on government methods proving inefficient, locally, with the help from the private sector, have made strides.

Last month, BizHive Weekly talked to the chief executive from the Human Resource Development Fund, Datuk Vignaesvaran who have highlighted that there were initiatives being done to train the local workforce including those in SMEs as well as those currently unemployed.

The issue now is thrown back at the respective sectors to actually send their human capital for training to upskill the current workforce.

As highlighted before, the concept that most employers in Malaysia fail to realise is that training the workforce is essential to the achievements of a business with the most positive benefit is of course, better employees.

The idea in this is that the better the employees are at their job, the easier it is for the company to attain the level of productivity required, and hence, success.

And while many more traditional SMEs still hold on to the fear of losing their staff post training, perhaps they should keep Richard Branson’s words in mind, “ Train people well enough so they can leave, treat them well enough so they don’t want to.”

As reinforced in the Eleventh Malaysia Plan, “An efficient and effective labour market is necessary for local, regional and global competitiveness which will attract foreign direct investments and propel Malaysia towards economic growth.”

Currently, Malaysia sits among 20 top economies on the Global Competitiveness Index (GCI) and will need to embrace solutions that will help them address challenges to include, skill shortages; talent mobility and talent retention.

“Up-skilling and re-skilling of our inherent talent and resources will not only fuel our high-priority sectors, creating high-income jobs, but will also help Malaysia transition from a developing to developed economy,” he enthused.

In terms of monetary support, local players are looking to aid SMEs. Earlier this week, CIMB Bank Bhd and Credit Guarantee Corporation Malaysia Bhd (CGC) have signed a memorandum of understanding (MoU) to add another RM750 million to the existing RM250 million Enterprise Clean Loan (ECL), as part of a joint initiative to nurture and develop Malaysian SMEs.

“The growth rate of SMEs is much faster than the country’s gross domestic product (GDP). By definition, it has become a clear focus area for us, both in terms of contribution towards the GDP and employment in the country,” said CIMB Group CEO of Group Consumer Banking, Renzo Viegas in a local media report.

In the report, CGC’s president and CEO Mohd Zamree Mohd Ishak added, “We hope to build the infrastructure (with our Asean counterparts) and then get participating banks, like CIMB or Maybank (to provide the loans).”

It was explained that since its Portfolio Guarantee’s inception in 2009, CGC have availed a total of RM4.6 billion worth of financing via 14 participating financial institutions while at the same time, issued 437,000 guarantees and financing for SMEs worth about RM59 billion over the last 44 years.

Recently it was shared that SME Corp Malaysia has, as of April this year, approved 40,000 applications in the form of grants and loans exceeding RM5 billion to Bumiputera entrepreneurs throughout the country.

Conducive trade agreements in play

Besides financial support, the fast changing ecosystem proves to be both an asset and a liability depending on if the entrepreneur and SME are able to cope or even think ahead of the curve.

The new digital revolution is no longer new; rather, it has become a necessity in today’s age of smartphones and tablets.

MCA vice president, Datin Paduka Chew Mei Fun was quoted saying that SMEs must consider remodelling their businesses and tap into new markets in the face of the challenging economic climate.

“In the nation’s paradigm shift to international trade, we are looking forward to increasing the export capability of our SMEs.

“We have the competitive advantage as Malaysia is ranked sixth (out of 140 economies) in the top 10 Most Competitive Asia-Pacific Economies in the Global Competitiveness Report 2015-2016 by the World Economic Forum,” she was quoted as saying.

Chew said SMEs should also make use of the resources and free trade agreement mechanism such as the Asean Economic Community and the Trans-Pacific Partnership Agreement.

“There will be stiff competition from foreign SMEs and large enterprises,” she added. “Hence, when SMEs brace for change and make necessary adjustments to advance with progressive initiatives, we can tap into new markets and opportunities and benefit from them.”

Touching on this, due to Malaysia’s strength in the halal market, markets such as China has not only opened but encouraged Malaysian companies to expand its businesses there.

China is offering investment incentives to Malaysian SMEs to set up in the YangLing Agro Processing Industrial Zone in Shaanxi province.

Recently a delegation comprising 17 corporate and government representatives were in China to match Malaysian SMEs with potential business in China, organised by the Secretariat for the Advancement of Malaysian Entrepreneurs (SAME).

According to a statement, it said that the Malaysian SMEs were given assurance that the Chinese government was ready to help them set up shop in China, and aware most SMEs did not have the means to acquire large factories in their early phases.

“We have arranged for this industrial zone to reduce the burden on SMEs by preparing customisable factories for rent at negotiable prices and other incentives,” said the statement.

It was vital for Malaysian SMEs to tap into the huge halal market in both the eastern and western parts of China, catering to both Muslim and non-Muslim consumers, it added.

“Halal F&B means adhering to health and hygiene standards. Here, all food processing factories need to obey highly stringent halal standards to meet the halal requirements,” it said.

The YangLing Zone will allow both Malaysia and China explore the high potential halal market and the incentives offered by China shows it welcomes investments from Malaysian SMEs with their halal knowledge and experience.

Other local media have added that Shandong, a leading agriculture and industrial province in China, has expressed interest in Malaysia’s proposal to develop its halal sector further and to encourage its industries to invest in Malaysia’s halal industrial parks.

To showcase Malaysia’s prowess in this halal subsector, Sime Darby Bhd is planning to set up a halal industrial park and a halal port in Weifang in the north of Shandong Province.

The company’s halal port and halal industrial zone, when launched, will be the first of their kind in China.

Gauging Sarawak’s SME participation

With approximately 44,000 small and medium enterprises (SMEs) in Sarawak, Minister of Industrial and Entrepreneur Development, Trade and Investment Datuk Amar Awang Tengah Ali Hassan highlighted that such number has represented 6.8 per cent of the total number of SMEs throughout the country, making the number of SMEs in Sarawak the fifth largest in Malaysia.

“SMEs are a key driver of our economic growth and therefore greater focus should be given to SME development in the state.

“This is clearly reflected in the recent change of my Ministry’s name from Ministry of Industrial Development Sarawak to the Ministry of Industrial and Entrepreneur Development, Trade and Investment Sarawak,” he stated when officiating the state level ‘SMEs Week 2016’.

“As Sarawak’s domestic market is small, SMEs must think big and go for export. We just have to target our neighbouring countries in the context of Asean Economic Community which has a total market size of 625 million consumers.

“Across our Miri border is Brunei, whose consumers have high purchasing power, while Kalimantan Barat next to Tebedu has a potential market of more than five million consumers.”

He said Sarawak hoped to achieve high income state by year 2030 and such aspiration can only be made into reality through industrialisation.

He noted that the government has set a clear target to increase the SMEs contributions by year 2020.

The targets, he said, are to increase the GDP from 33 per cent to 41 per cent, workforce and to increase the export aspect from 19 per cent to 23 per cent.

“Sarawak is rich with natural resources and that’s why we encourage investment in high technology industries to increase value added in the economy.

“At the same time, SMEs should be more creative and innovative in effort continue to compete in the challenging global world,” he added.

Source: Standard Chartered Research

Digital revolution is now everyday expectation

Google Malaysia has also offered their assistance for SMEs to enter the digital revolution and prioritize an online presence due to higher smartphone penetration.

“Today’s battle for customers is won in `micro moments’ – the spontaneous moments of decision-making and preference-shaping that dictate outcomes throughout the entire consumer journey, which is happening with consumers on smartphones.

“We think there is tremendous growth potential for Malaysian SMEs, given the mobile-first nature of Internet users here,” said managing director of Google Malaysia, Vietnam, Philippines and New Emerging Markets Sajith Sivanandan in a statement, in conjunction with `Go Digital’ workshop held here in collaboration with SME Corporation Malaysia (SME Corp) and Maxis.

But the question now remains, is having an online presence enough in the age of ‘everyday digital’?

While there is no denying the importance of digital information, just like real estate, placing ads is all about ‘location, location, location.’

Target marketing strategies, as well as social media marketing is the new wave that successful small SMEs are arming themselves with to fight the big boys with big budgets.

Where a website acts as a platform, mobile technology such as tablets and smartphones act as medium to attract customers.

Take for example that most working women who cannot afford to shop visiting a store will shop her groceries, and her daily needs online at the push of a button.

A person waiting for a bus or a person waiting in a queue will take a quick look at e-commerce sites for their needs or research a bit regarding the price options available on various fronts.

This growth proves how essential mobile growth is for e-commerce.

The online toolset is far broader than just having a website customers can find through a search engine. Firms need to explore and exploit four online toolsets to stay relevant: the cloud; social; mobile; and data analytics.

In terms of mobile, there are courses being offered on creation of mobile sites, target ads as well as social media marketing. But how many SMEs have embraced and utilized this tool is the main question.

Firms that adopt new online tools fast are faster growing, more profitable, generate more jobs, and they innovate and export more. The causation goes both ways – firms with growth opportunities find advanced tools more valuable – but the tools clearly help firms to capture opportunities.

Entrepreneurship can have several positive effects on growth, namely boosting employment, raising productivity and speeding up innovation. It is little wonder then that governments are focusing on entrepreneurship as a way to lift economies out of growth stagnation.

Now while the Standard Chartered report noted that not all entrepreneurs are equally important for growth, it is however, agreed that to a certain extent, they all give back to the economy.

Looking locally, with the increased funding from multiple parties such as CGC and CIMB, aid from Google, training programs from HRDF and Malaysia’s trade connection, it is safe to say while it can always be improved, it is far from the worst.