JD.com is not just a traditional e-commerce platform, but also a pioneer in pushing boundaries in industrial IoT and automation. The company’s slow but steady build-up of its integrated smart supply chain gives them a strong footing in capturing the growth in online retail and the changing regulatory landscape.

JD.com is not just a traditional e-commerce platform, but also a pioneer in pushing boundaries in industrial IoT and automation. The company’s slow but steady build-up of its integrated smart supply chain gives them a strong footing in capturing the growth in online retail and the changing regulatory landscape.

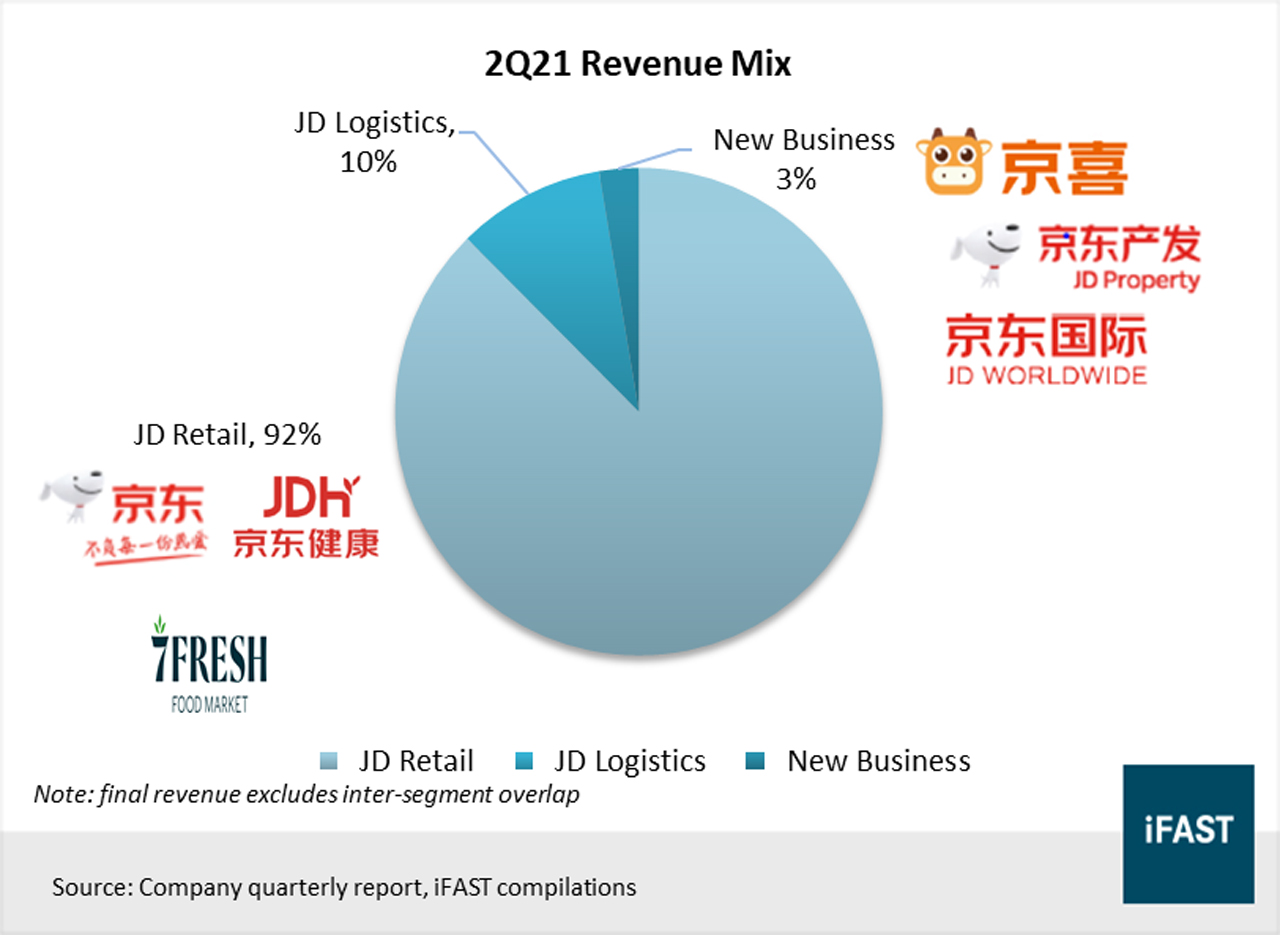

Founded in 2004, JD.com is China’s second-largest e-commerce platform. It is also Alibaba’s greatest rival in China’s e-commerce market. The company has three business segments – retail, ;ogistics and new business.

The largest segment is the JD retail segment, which makes up approximately 92 per cent of total revenue. About 60 per cent of this comes from electronic product sales, but recently, general merchandise (apparel, beauty, fresh food, healthcare, etc.) has been gaining traction. As of 2Q21, only JD Retail is making an operating profit, as the other two segments are still in investment stage.

JD Logistics (JDL) generates its revenue by providing supply chain solutions and logistics services, including warehousing and distribution services, express and freight delivery services, bulky item logistics services, cold chain logistics services, and cross-border logistics services.

The new business segment consists of JD Property and other initiatives, including community group buying and overseas businesses. JD Property manages JD.com’s infrastructure assets and real estate, supporting the development of the integrated smart supply chain.

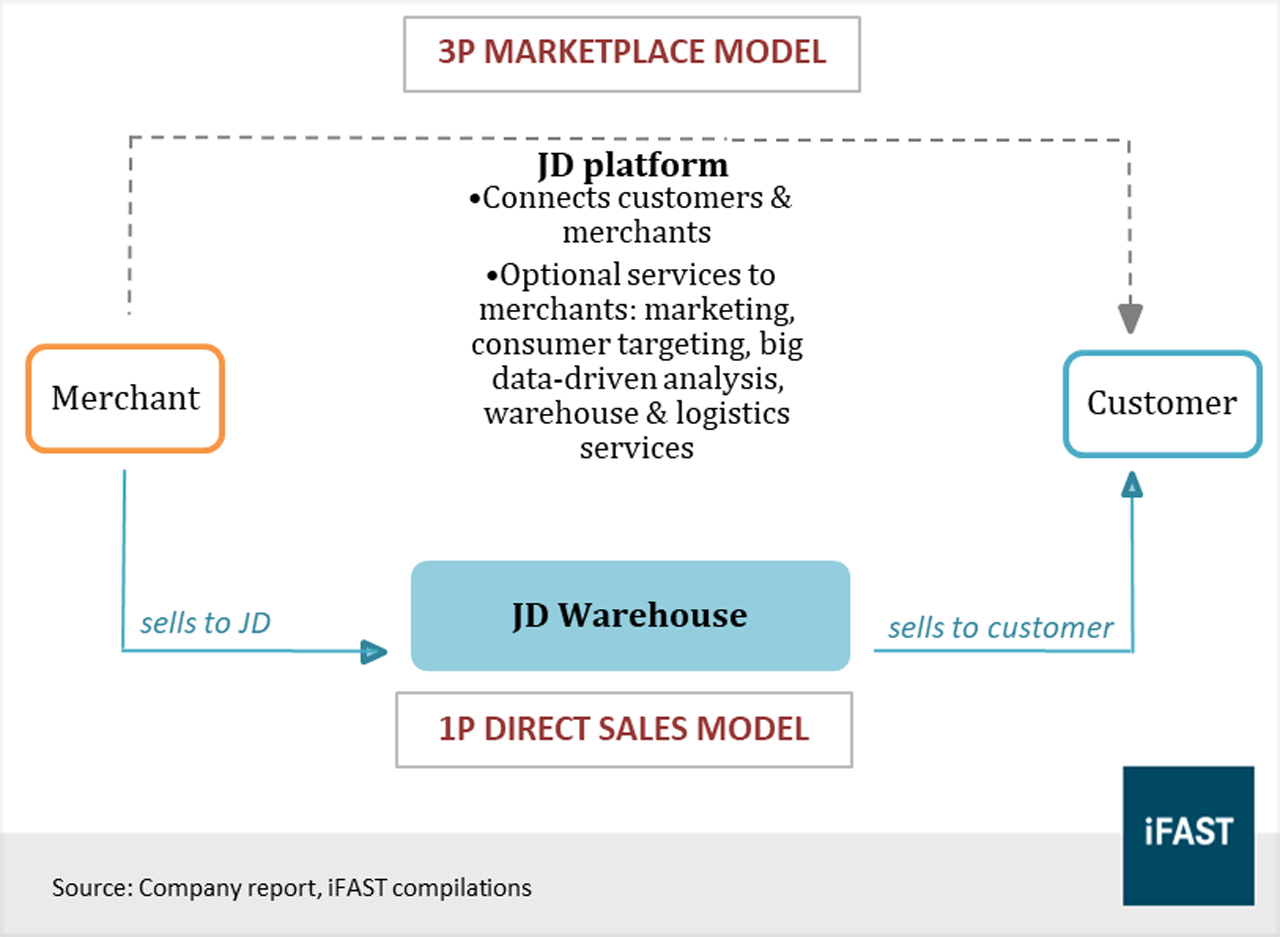

The company operates through a combination of first-party (1P) and third-party marketplace model (3P). For the 1P model, JD.com purchases inventory wholesale from merchants, and manages the inventory, from distribution and to sales process, taking on the inventory risk and storing it in their warehouses.

While for the 3P model, merchants sell direct to customers through JD.com’s e-commerce platform and pay a percentage fee of the transaction, which is recognised under JD Retail. In this model, JD.com does not manage the inventory and distribution process.

To put this in context, at the core, JD.com is a retailer as more than 85 per cent of revenue comes from the direct sales 1P model, while Alibaba is a marketplace, only operating with the 3P model. Even though the main segment is JD Retail, the smart supply chain is what gives the company its competitive edge.

JD Retail makes up more than 90 per cent of total revenue

JD.com’s business model

Logistics gives JD.com an edge over its peers

JD.com has invested heavily in its logistics business over the years to build up its extensive supply chain network and is a pioneer challenging the boundaries in China in “New Infrastructure”, implementing industrial IoT, factory automation, and AI to their warehouse and logistic chains.

Across 28 cities, the company operates an extensive network of 38 “Asia No.1 smart mega warehouses”, which ranks among the top in scale and automation, in Asia. JD.com also operates the first global fully unmanned B2C warehouse in Shanghai and has established the first 5G smart logistics park in China.

JD.com is China’s largest integrated supply chain logistics services provider in terms of revenue, offering a one-stop service solution for all supply chain needs.

On top of the platform and delivery business, JD.com also offers a whole suite of value-added integrated smart supply chain services. Whereas most other e-commerce competitors are just a platform, and logistics competitors are just in a certain segment of the delivery business.

Alibaba is also ramping up its smart supply chain. However, the difference is that its focus is on freight between warehouses, while JD.com offers integrated end-to-end logistics.

Globally, JD.com is the only e-commerce company to provide small-to-medium sized warehousing, oversized warehousing, cross border, cold chain delivery, frozen and chilled warehousing facilities, B2B and crowdsourcing logistics.

Furthermore, the company offers other services such as consumer behaviour insights, smart inventory management and allocation, by harnessing data from their in-house AI and machine learning platform.

Their superior integrated smart supply chain has made it possible for JD.com to deliver one of the most efficient and quality offerings, setting the industry standards in inventory management and delivery.

JD.com is the only e-commerce company to achieve same-day delivery, some even within two hours, and is the first company in the world to make commercial deliveries by drone.

Among leading global retailers, JD.com has one of the lowest inventory turnover days with consistent improvement, beating Amazon by roughly four days.

While the infrastructure investments have previously dragged on earnings, they now provide JD.com with a strong moat, putting the company in a strong position to capture the next growth driver in online retail, and acting as a competitive edge in the changing regulatory landscape.

JD.com has an extensive logistics network, at least 11 times larger in total gross floor area than SF express, a major logistics competitor.

The integrated smart supply chain offerings form the crux of the business as it drives the growth of all segments.

Gaining market share following China’s Big Tech crackdown

We expect JD.com to be a beneficiary in China’s Big Tech crackdown, enjoying market share gains as China moves to the end of the “two choose one” exclusivity contracts, and the company’s business alignment with government goals is also a positive growth factor.

As China comes to an end of the “two choose one” exclusivity contracts that Alibaba used to enforce, JD.com will enjoy the growth of merchants on its platforms, which is a key revenue driver.

Since the fine on Alibaba in April this year, JD.com has seen the return of brands such as Starbucks, Bvlgari, and Victoria Secret’s.

On top of that, JD.com’s business aligns with government goals of technological innovation and business for good. As a pioneer in smart supply chain, the company’s business contributes to the goal of modernising and upgrading the supply chain infrastructure.

The business also creates positive externalities and contributes good to society in multiple ways, one of which is that because of the advanced smart supply chain driven by data analytics, efficient inventory management and delivery planning reduces wastage, improves inventory turnover, thus boosting margins and is also beneficial to the environment.

Another example would be JD.com’s robot and drone delivery. Not only does these break boundaries in innovation, but they have also proven to be a true asset to society, especially during Covid-19, enabling contactless delivery and delivery of critical health supplies to inaccessible mountainous areas.

Therefore, as a pioneer in innovation and as a business that creates societal value, they are on the right track of alignment with the government’s goal of innovative and sustainable growth of the country. Thus, we like the company and expect long-term sustainable growth.

Luxury online retail to be a growth driver for JD.com

The shift to online retail continues to be a driver for JD.com, especially in the luxury segment, as affluent Chinese consumers have displayed an increasing willingness to shop for luxury goods online. On the first day of Singles Day sale in November last year, within the first 30 minutes, brands including Salvatore Ferragamo, Ralph Lauren, and Tod’s saw sales up 10 times year-over-year.

Additionally, we notice that multiple luxury brands have made JD.com their choice e-commerce platform. In the past year, multiple brands of LVMH have established partnerships with JD.com, with LVMH’s Louis Vuitton choosing JD.com as the platform to launch their venture into the e-commerce business.

Brands are choosing JD.com for multiple reasons, including the premium supply chain services, JD.com’s strength in fighting counterfeit goods, and the pool of less price-sensitive customers. All these are only possible because of JD.com’s focus on building its smart supply chain capability.

Therefore, this reinforces our argument that JD.com’s competitive moat in its integrated smart supply chain is what enables the company to capture the growth driver of online retail.

Furthermore, 2Q21 results add confidence to our thesis on JD.com capturing the growth drivers of market share gain and online retail shift. 2Q21 revenue beat expectations, on the back of exceptionally good growth of active customers. Active customers hit 532 million, growing 27 per cent year on year. which is the largest quarterly addition in JD.com’s history.

In conclusion, JD.com’s smart supply chain technology acts as the company’s competitive moat in capturing the next wave of online retail and gives it a strong footing to emerge strongly from the current regulatory environment.

With the various growth drivers, we expect strong earnings growth as the company enjoys economies of scale, driven by merchant and customer growth, and increasing external customers for JD Logistics. However, earnings in 2021 is likely to be weak as JD.com continues to focus on supply chain expansion, especially in lower-tier cities.