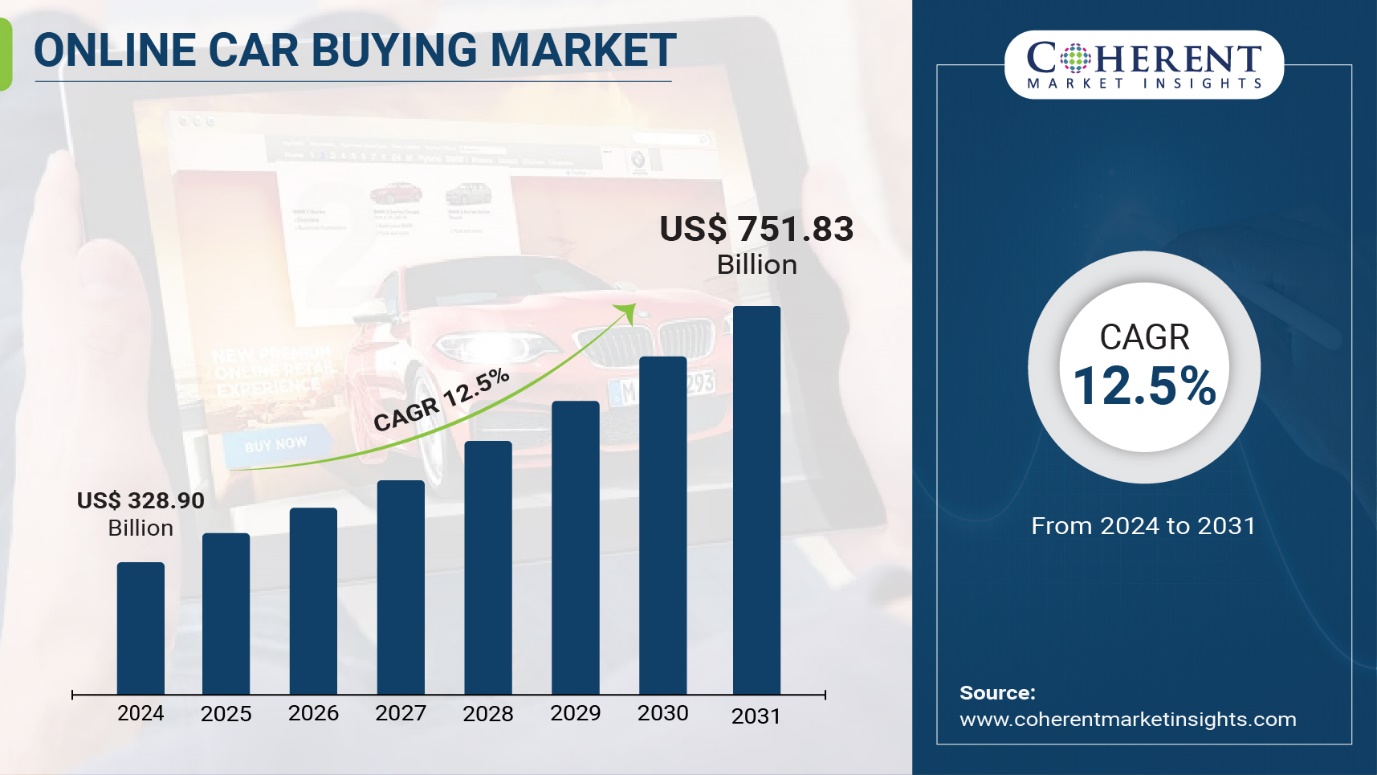

Online Car Buying Market Size to Hit $751.83 billion by 2031, growing at a CAGR of 12.5%, says Coherent Market Insights

The Online Car Buying Market is estimated to be valued at US$ 328.90 Bn in 2024 and is expected to exhibit a CAGR of 12.5% over the forecast period 2024-2031, as highlighted in a new report published by Coherent Market Insights. Companies covered: American City Business Journals Inc., Asbury Automotive Group Inc., AutoNation Inc., CarGurus Inc., CarMax Inc., Cars and Bids LLC, Cars.com Inc., Cars24 Services Pvt. Ltd., CarSoup of Minnesota Inc., Carvago, Carvana Co., Cox Enterprises Inc., eBay Inc., Edmunds.com Inc., Hendrick Automotive Group, Lithia Motors Inc., MH Sub I LLC, Miami Lakes Automall, TrueCar Inc.

/EIN News/ -- Burlingame, July 24, 2024 (GLOBE NEWSWIRE) -- The Global Online Car Buying Market size was valued at US$ 328.90 Billion in 2024 and is expected to reach US$ 751.83 Billion by 2031, growing at a compound annual growth rate (CAGR) of 12.5% from 2024 to 2031, as highlighted in a new report published by Coherent Market Insights. Online car buying provides the convenience of researching various models, comparing prices, getting complete details and even applying for loan from the comfort of home. Customers can browse through inventory 24/7 without any pressure tactics used in dealership. This convenience of browsing and purchasing a car online without wasting time is a major attraction for customers.

Request Sample Report: https://www.coherentmarketinsights.com/insight/request-sample/6983

Market Dynamics:

The major drivers fueling the growth of the online car buying market are increasing adoption of online shopping and growing preference for convenience. With rising internet and smartphone penetration, customers are increasingly opting for online channels to research and purchase cars due to benefits such as convenience of comparing multiple options from the comfort of their home, transparent pricing, and hassle-free purchase process. Furthermore, major car companies and dealers are investing heavily in strengthening their online presence to tap into this growing online customer base.

Market Trends:

Rise of intelligent virtual assistants: Major players in the market are focusing on integration of virtual intelligent assistants to enhance the online car buying experience. For instance, companies are developing chatbots and voice assistants that can help customers with tasks like obtaining quotes, applying for loans, and completing paperwork.

Customization and personalization of purchase experience: Dealers are gathering customer data insights to offer a highly personalized experience during the car selection and purchase process online. Customers can now customize and design their ideal car as per their preferences using 3D configurators available on company websites before buying.

Online Car Buying Market Report Coverage

| Report Coverage | Details |

| Market Revenue in 2024 | $328.90 billion |

| Estimated Value by 2031 | $751.83 billion |

| Growth Rate | Poised to grow at a CAGR of 12.5% |

| Historical Data | 2019–2023 |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Vehicle Type, By Propulsion Type, By Category |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of World |

| Growth Drivers | • Emergence of Advanced Online Tools • Rise of Multichannel Integration |

| Restraints & Challenges | • Inability to physically inspect vehicle before purchase • Lack of trust in online purchase of high ticket item |

Market Opportunities:

The sale of new vehicles online is expected to witness significant growth during the forecast period. Various automakers are focusing on enhancing their online presence and digital marketing strategies to boost new vehicle sales. For instance, companies are allowing customers to customise their vehicle options, get real-time offers and financing details, and schedule test drives directly through their websites or dedicated mobile apps. This is making the entire purchase process seamless and convenient for consumers. Moreover, Covid-19 accelerated the shift towards online shopping, benefiting new vehicle online sales.

Immediate Delivery Available | Buy This Premium Research Report: https://www.coherentmarketinsights.com/insight/buy-now/6983

Sales of pre-owned or used vehicles online have been growing rapidly over the last few years. Websites such as CarGurus and TrueCar have made it easy for customers to search inventory from multiple dealers, compare vehicles and prices, and get vehicle history reports, all from the convenience of their homes. Many traditional dealers are also investing in upgrading their pre-owned vehicle sections online. The availability of additional information and easier search options is expected to drive further growth in online used car sales during the forecast period.

Key Market Takeaways

The global online car buying market is anticipated to witness a CAGR of 12.5% during the forecast period 2024-2031, owing to the growing preference of consumers towards contactless shopping and convenience of comparing multiple options online.

On the basis of vehicle type, the hatchback segment is expected to hold a dominant position, accounting for over 30% of the market share owing to popularity of these vehicles among family sedan buyers in developed markets.

On the basis of propulsion type, the petrol segment is expected to dominate the market over the forecast period, due to affordability and widespread availability of fuels.

On the basis of category, the pre-owned vehicle segment is expected to hold the major share till 2031, since majority of customers still perceive online channel safer for used cars compared to new cars.

North America is expected to hold a dominant position over the forecast period, owing to high internet penetration and the presence of major players.

Key players operating in the online car buying market include Asbury Automotive Group Inc., AutoNation Inc., Cargurus Inc. These companies are focusing on strategic partnerships and collaborations to expand their online presence and service offerings.

Recent Developments:

In November 2022, AutoNation Inc. has unveiled its recent acquisition of approximately 6.1% of TrueCar. TrueCar stands as a prominent digital marketplace within the automotive industry, facilitating connections between car buyers and sellers through its extensive network of Certified Dealers nationwide. AutoNation's decision to invest in TrueCar underscores its unwavering dedication to emerging technologies and its persistent commitment to delivering unparalleled customer experiences.

In November 2023, CarGurus Inc. has reached an agreement to complete the acquisition of CarOffer in its entirety. This strategic move underscores CarGurus' commitment to expanding its presence and capabilities within the automotive market. CarOffer, a notable player in the industry, specializes in providing innovative technology solutions that facilitate vehicle buying and selling processes.

Request For Customization: https://www.coherentmarketinsights.com/insight/request-customization/6983

Market Segmentation

By Vehicle Type:

- Hatchback

- Sedan

- SUV

- Others

By Propulsion Type:

- Petrol

- Diesel

- Others

By Category:

- Pre-Owned Vehicle

- New Vehicle

By Regional:

North America:

- U.S.

- Canada

Latin America:

- Brazil

- Argentina

- Mexico

- Rest of Latin America

Europe:

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

Asia Pacific:

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

Middle East:

- GCC Countries

- Israel

- Rest of Middle East

Africa:

- South Africa

- North Africa

- Central Africa

Browse More Trending Reports:

Vehicle Protection Service Market: The Global Vehicle Protection Service Market size is estimated to be valued at US$ 146.01 Bn in 2023 and is expected to reach US$ 288.3 Bn by 2030, grow at a compound annual growth rate (CAGR) of 10.2% from 2023 to 2030.

Vehicle Subscription Market: The vehicle subscription market is estimated to be valued at USD 4.52 Bn in 2024 and is expected to reach USD 35.49 Bn by 2031, growing at a compound annual growth rate (CAGR) of 34.2% from 2024 to 2031.

Global Amphibious Vehicle Market: The amphibious vehicle market is estimated to be valued at US$ 5.08 Bn in 2024 and is expected to reach US$ 10.50 Bn by 2031, growing at a compound annual growth rate (CAGR) of 10.9% from 2024 to 2031.

Armored Vehicle Market: The Global Armored Vehicle Market is estimated to be valued at US$ 28.45 Bn in 2024 and is expected to reach US$ 42.21 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 5.8% from 2024 to 2031.

About Us:

Coherent Market Insights is a global market intelligence and consulting organization that provides syndicated research reports, customized research reports, and consulting services. We are known for our actionable insights and authentic reports in various domains including aerospace and defense, agriculture, food and beverages, automotive, chemicals and materials, and virtually all domains and an exhaustive list of sub-domains under the sun. We create value for clients through our highly reliable and accurate reports. We are also committed in playing a leading role in offering insights in various sectors post-COVID-19 and continue to deliver measurable, sustainable results for our clients.

Mr. Shah

Senior Client Partner – Business Development

Coherent Market Insights

Phone:

US: +1-206-701-6702

UK: +44-020-8133-4027

Japan: +81-050-5539-1737

India: +91-848-285-0837

Email: sales@coherentmarketinsights.com

Website: https://www.coherentmarketinsights.com

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.