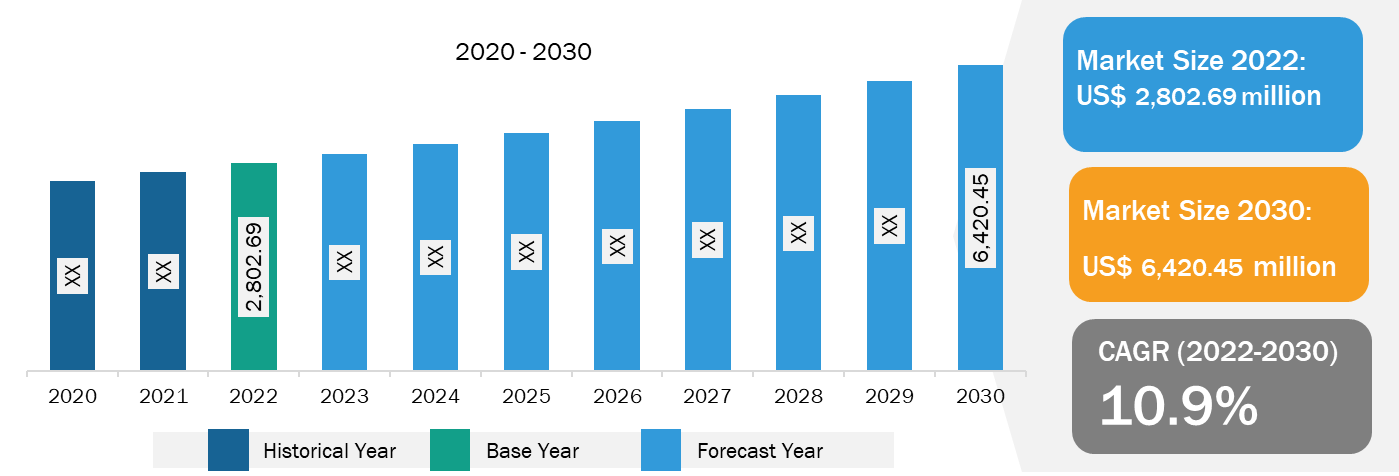

Horizontal Directional Drilling (HDD) Market Size worth $6.42 billion by 2030 With Growing at CAGR 10.9% - Exclusive Report by The Insight Partners

Horizontal Directional Drilling (HDD) Market research includes key company profiles like are American Augers, Inc.; Prime Drilling GmbH; Epiroc AB; Vermeer Corporation; The Charles Machine Works Inc.; Laney Directional Drilling; Nabors Industries Ltd; Herrenknecht AG; Tracto-Technik; and Drillto Trenchless Co., Ltd.

/EIN News/ -- US & Canada, March 28, 2025 (GLOBE NEWSWIRE) -- According to a new comprehensive report from The Insight Partners, “the global Horizontal Directional Drilling (HDD) Market Size and Forecast (2022 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By End-use (Telecommunications, Oil & Gas, Sewer & Water, Environmental Wells, and Utility), Rig Size [Small (Less than 40,000 lbs.), Medium (40,000–100,000 lbs), and Large (More than 100,000 lbs.)], and Application (Onshore and Offshore), and Geography”.

For More Information and To Stay Updated on The Latest Developments in The Horizontal Directional Drilling (HDD) Market, Download The Sample Pages: https://www.theinsightpartners.com/sample/TIPRE00022032/

The report runs an in-depth analysis of market trends, key players, and future opportunities. Rising infrastructure development in telecommunications and mineral exploration sectors, discovery of new mineral exploration locations, and development of smart cities across emerging countries are some of the factors boosting the market growth.

For Detailed Horizontal Directional Drilling (HDD) Market Insights, Visit: https://www.theinsightpartners.com/reports/horizontal-directional-drilling-hdd-market

Market Overview and Growth Trajectory:

Horizontal Directional Drilling (HDD) Market Growth: The horizontal directional drilling (HDD) market is expected to reach US$ 6.42 billion by 2030 from US$ 2.80 billion in 2022; it is expected to record a CAGR of 10.9% during the forecast period. Growing number of exploration activities in the oil & gas sector and rising number of new mineral exploration projects boost the growth of the horizontal directional drilling market globally. The increasing demand for broadband services in North America is anticipated to boost investments in the cable network. The next-generation broadband technologies such as high-speed internet packages (FTTx) and 5G are increasing the deployment of cables, which is propelling the need for horizontal directional drilling activities in the region. In 2023, AT&T aimed at expanding 5G and fiber networks to connect urban, rural, and tribal communities nationwide. The growing requirement of drilling activities for installing underground cables and conduits is boosting the demand for horizontal directional drilling equipment in different countries across Europe. In 2023, Prysmian Group initiated horizontal directional drilling activity that will grant the subsea cables to establish an energy transmission connection between Germany and the UK.

Increasing Application of Horizontal Directional Drilling Equipment in Sewer & Water and Oil & Gas Sectors: The volume of sewage is rising with population growth. A majority of wastewater is generated by households and industries. Every year, ~380 billion m3 (cubic meters) of municipal wastewater is produced globally. As a result, the demand for proper infrastructure development in the sewer & water sector is increasing due to the growing population and rising urbanization. Governments of several countries are focusing on installing proper wastewater and sewage treatment facilities to protect the environment from pollution. For instance, in 2024, The Ranchi Municipal Corporation initiated a pipeline laying project under its sewage management system across nine wards. The project involves joining household septic tanks to the sewer lines. In addition, in 2023, Cambi signed an agreement focusing on the Woodman Point Water Resource Recovery Facility in Perth and Western Australia. In 2022, more than 16,000 public wastewater treatment facilities were in the US. Over 80% of the US population consumes drinking water from these facilities after proper treatment, and approximately 75% of the US population has sanitary sewerage treated in these treatment facilities. The growing emphasis on proper sewer and water infrastructure is boosting drilling activities, which is increasing the application of horizontal directional drilling equipment worldwide.

Stay Updated on The Latest Horizontal Directional Drilling (HDD) Market Trends: https://www.theinsightpartners.com/sample/TIPRE00022032/

Rising Infrastructure Development in Telecommunications and Mineral Exploration Sectors: The growing urbanization and rising government focus on infrastructure development that involve network expansion in rural areas are a few factors increasing the application of horizontal directional drilling equipment. For instance, in 2024, Bharat Sanchar Nigam Limited declared a US$ 7.8 billion tender to employ the third Phase of the BharatNet project, which is one of the important rural telecom projects. In 2023, Grid Telecom and Exa Infrastructure collaborated to boost digital connectivity and offer infrastructure services anchored in Europe. The partnership is focusing on offering their wholesale and corporate customers diverse open-access interconnection and international reach across Europe. In 2023, Chinese state-owned telecom firms such as China Mobile Limited, China Telecommunications Corporation, and China United Network Communications Group Co Ltd (China Unicom) are developing a US$ 500 million undersea internet cable network that is anticipated to connect the Middle East, Asia, and Europe. In 2022, Telecom Italia (TIM) won contracts worth US$ 86.94 million in a government tender to develop 5G networks in the rural area of Italy. With these initiatives, the number of underground cable installations for expanding telecom connections in remote locations is also growing.

Discovery of New Mineral Exploration Locations: Mineral exploration activities are one of the major application areas of horizontal directional drilling equipment. The mineral exploration sites require a high level of drilling activities, which is boosting the demand for horizontal directional drilling equipment in various nations. Countries such as Australia, China, Russia, Brazil, Canada, and the US are widely involved in mineral exploration activities. These countries are also promoting the discovery of new mineral exploration sites and upgrading and maintenance of already existing sites. For instance, in 2024, American Pacific Mining Corp. presented its project update, which includes 2024 exploration plans for its Madison Copper-Gold Project located in Madison County, Montana. The 2024 exploration agenda includes a near-mine of 1,350 m; a five-hole Phase I diamond drilling program; a planned Phase II regional drill program; and detailed groundwork.

Geographical Insights: In 2022, North America led the market with a substantial revenue share, followed by Asia Pacific, Europe, Middle East & Africa, and South America respectively. Middle East & Africa is expected to register the highest CAGR during the forecast period.

Horizontal Directional Drilling (HDD) Market Segmentation, Applications, Geographical Insights:

- Based on end user, the horizontal directional drilling (HDD) market is segmented into telecommunication, oil & gas, sewer & water, environmental wells, and utility. The oil & gas segment held the largest market share in 2022.

- By rig size (thrust/pullback), the horizontal directional drilling (HDD) market is divided into small (below 40,000 lbs), medium (40,000 - 100,000 lbs), and large (above 100,000 lbs). The large (above 100,000 lbs) segment held a larger share of the market in 2022.

- Based on application, the horizontal directional drilling (HDD) market is divided into onshore and offshore. The onshore segment held a larger share of the market in 2022.

Need A Diverse Region or Sector? Customize Research to Suit Your Requirement: https://www.theinsightpartners.com/inquiry/TIPRE00022032/

Key Players and Competitive Landscape:

The Horizontal Directional Drilling (HDD) Market is characterized by the presence of several major players, including:

- American Augers, Inc.

- Prime Drilling GmbH

- Epiroc AB

- Vermeer Corporation

- The Charles Machine Works Inc.

- Laney Directional Drilling

- Nabors Industries Ltd

- Herrenknecht AG

- Tracto-Technik

- Drillto Trenchless Co., Ltd

These companies are adopting strategies such as new product launches, joint ventures, and geographical expansion to maintain their competitive edge in the market.

Horizontal Directional Drilling (HDD) Market Recent Developments and Innovations:

- " American Augers introduced the DD600 maxi-rig directional drill, replacing its predecessor, the DD440T.”

- “Vermeer launched the LS3600TX low-speed shredder, designed for recycling, waste facilities, land clearing, compost, mulch, and biofuel production.”

- “Herrenknecht AG acquired the majority of H. Anger's Sohne Bohr- and Brunnenbaugesellschaft mbH.”

Purchase Premium Copy of Global Horizontal Directional Drilling (HDD) Market Size and Growth Report (2022-2030) at: https://www.theinsightpartners.com/buy/TIPRE00022032/

Conclusion:

The horizontal directional drilling market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. North America, Europe, and Asia Pacific are major regions. The high presence of manufacturers and suppliers of horizontal directional drilling equipment in North America, such as American Augers, Ditch Witch (The Charles Machine Works, Inc), and Vermeer Corporation, is acting as a major driver for the horizontal directional drilling market growth in the region.

Growing number of exploration activities in the oil & gas sector and rising number of new mineral exploration projects boost the growth of the horizontal directional drilling market globally. The increasing demand for broadband services in North America is anticipated to boost investments in the cable network. The next-generation broadband technologies such as high-speed internet packages (FTTx) and 5G are increasing the deployment of cables, which is propelling the need for horizontal directional drilling activities in the region. In 2023, AT&T aimed at expanding 5G and fiber networks to connect urban, rural, and tribal communities nationwide. The growing requirement of drilling activities for installing underground cables and conduits is boosting the demand for horizontal directional drilling equipment in different countries across Europe. In 2023, Prysmian Group initiated horizontal directional drilling activity that will grant the subsea cables to establish an energy transmission connection between Germany and the UK.

The construction of new offshore oil and gas fields across different countries in Asia Pacific such as China, South Korea, and Japan propels the demand for horizontal directional drilling equipment across the region. In July 2023, Malaysian government company Petronas stated that it had constructed six new locations for offshore oil and gas facilities.

The expanding demand for natural gas and crude oil in different end-use applications bolsters the growth of the oil & gas pipeline infrastructure in Middle East & Africa, which is increasing the scope of drilling activities and having a positive impact on the horizontal directional drilling market. Rising offshore oil drilling activities are also boosting the demand for horizontal directional drilling equipment in the region. In January 2023, Masirah Oil, a subsidiary of Singapore-headquartered independent Rex International, announced that it had completed an offshore drilling campaign in Oman's Block 50. Thus, growing development of the oil & gas sector is projected to drive the horizontal directional drilling market growth in the Middle East & Africa during the forecast period.

The expanding energy demand in South & Central America is attributed to population growth and industrialization, which fuels the need for increased gas production. As a result, the gas industry in South & Central America attracts significant investments from domestic and foreign companies. Partnerships between national oil companies and international collaborators drive the oil & gas industry's growth. In August 2023, Exxon announced its plans to develop its sixth offshore oil project worth US$ 12,93 billion in Guyana. Such developments have been catalyzing the horizontal directional drilling market growth in South & Central America.

Related Report Titles:

-

Directional Drilling Services Market Key Players Analysis and Growth Forecast by 2031

-

Managed Pressure Drilling Market Growth and Recent Trends by 2031

-

Multi-Pad Drilling Market Size, Share, Growth, Trends, and Forecast by 2031

-

Magnetic Drilling Machine Market Strategies and Forecast by 2031

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

Contact Us:

If you have any queries about this report or if you would like further information, please contact us:

Contact Person: Ankit Mathur

E-mail: ankit.mathur@theinsightpartners.com

Phone: +1-646-491-9876

Press Release: https://www.theinsightpartners.com/pr/horizontal-directional-drilling-hdd-market

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, Media, Advertising & PR, Science ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release