Texas Businesses Strengthen Financial Operations Through Outsourced AP and AR Management

Outsourced AP and AR management helps Texas companies cut costs, improve accuracy, and manage cash flow more effectively.

MIAMI, FL, UNITED STATES, April 17, 2025 /EINPresswire.com/ -- As financial departments across Texas face growing pressures from high invoice volumes, delayed collections, and reconciliation inefficiencies, a growing number of companies are turning to outsourced AP and AR management to improve accuracy, reduce costs, and stabilize their cash flow.Businesses are rarely relying solely on in-house teams to manage AP and AR. Instead, many are opting for specialized outsourcing services that offer round-the-clock support, experienced professionals, and technology-driven workflows—proving that this approach is both cost-effective and operationally beneficial.

Streamline your payables and receivables with ease.

Book Now: https://www.ibntech.com/free-consultation/

Why Texas Companies Are Reassessing Internal Finance Processes

Across the state, finance teams are encountering challenges that disrupt cash flow and delay reporting cycles. Managing AP and AR functions in-house is becoming increasingly difficult due to limited staffing and rising transactional complexity.

Issues being reported by Texas organizations include:

1) Invoice approvals are taking too long, delaying payments to vendors.

2) Overdue receivables are increasing, leading to poor Days Sales Outstanding (DSO) performance.

3) Internal staff lack the capacity to consistently follow up or escalate issues.

4) Errors occurring in cash applications, vendor reconciliation, and financial reporting.

5) Month-end closing processes are inefficient and often stressful during audits.

6) These ongoing problems are impacting vendor relationships, financial visibility, and operational reliability.

Texas Firms Turning to Offshore Financial Partners for AP and AR Support

To overcome ongoing mentioned challenges in managing payables and receivables, many Texas companies are now partnering with offshore financial service providers. These firms specialize in delivering outsourced AP and AR management, serving end-to-end solutions that align with U.S. accounting and finance standards integrating smoothly with existing financial systems.

Service providers based in global finance hubs like India are becoming valuable allies for Texas businesses seeking consistent processing, compliance support, and scalable financial workflows. Companies report greater efficiency and reduce administrative burden when delegating AP and AR responsibilities to these external experts.

Ajay Mehta, CEO of IBN Technologies, stated, “Accounts payable and receivable directly influence cash flow, vendor trust, and audit readiness. When internal teams are overwhelmed, outsourcing becomes a well-calculated strategy that supports business continuity and financial control.”

IBN Technologies provides highly trained accounting professionals in India who manage the complete AP/AR cycle for clients in the United States. The service ensures consistency, real-time reporting, and adherence to financial best practices.

Measurable Benefits of Outsourced AP and AR Management

Texas companies utilizing outsourced AP and AR management are seeing measurable improvements across key performance areas:

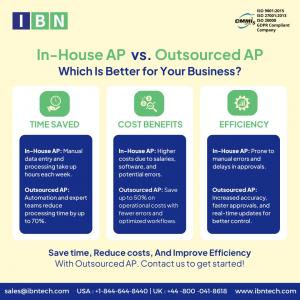

1) Time Savings: By outsourcing invoice processing, payment handling, and collections, internal teams can focus on higher-value strategic tasks.

2) Stronger Cash Flow: Timely accounts receivable collections and optimized vendor payments ensure a more predictable financial cycle.

3) Improved Compliance: External experts manage documentation, reconciliation, and reporting in accordance with financial regulations.

4) Scalability: Services can expand with business needs, eliminating the requirement to hire additional in-house staff.

5) Expert Access and Automation: Outsourced providers offer a combination of skilled personnel and modern financial software that enhances accuracy and reduces manual errors.

Verified Outcomes of Outsourced AP and AR Services in the U.S.

1) A U.S.-based retail SME shortened its invoicing cycle by 85% and secured annual savings of $50,000 by adopting streamlined processes enabled through outsourced AP and AR management.

2) A manufacturing company in Illinois achieved a 92% boost in payment accuracy, which led to enhanced supplier interactions and improved overall operational performance.

Industry Applications of Financial Outsourcing in Texas

Organizations from a range of sectors in Texas are embracing financial outsourcing as a way to stay competitive and focused on core operations. These industries include:

1) Healthcare: Medical offices and health groups are outsourcing AP/AR to handle complex billing and payment reconciliation more efficiently.

2) Legal Services: Law firms use outsourced financial services to ensure accurate trust account management and billing compliance.

3) E-Commerce and Retail: Online businesses and brick-and-mortar retailers are outsourcing financial tasks to manage large transaction volumes and improve collection cycles.

Outsource smarter—discover financial services designed for your industry.

Explore Affordable Pricing Plans: https://www.ibntech.com/pricing/

Each industry has its own challenges, and outsourcing offers customized solutions to meet those needs without increasing internal workloads.

Strategic Realignment for Sustainable Growth

The decision to implement outsourced AP and AR management is increasingly being seen as a strategic business move rather than a cost-cutting measure alone. Texas companies are using outsourcing to unlock internal capacity, enhance reporting accuracy, and drive more predictable cash flow, which is especially important in a fast-paced economic environment.

Rather than expanding internal accounting teams, many organizations are choosing to rely on proven outsourcing partners who bring both domain expertise and modern infrastructure.

Explore Financial Solutions for Your Business in Texas

Texas-based companies interested in transforming their financial operations can now access tailored AP and AR solutions designed to scale with business growth and maintain regulatory compliance. IBN Technologies provides comprehensive onboarding support, transparent service models, and pricing plans that fit a variety of business sizes and industries.

Related Services:

Robotics process automation

https://www.ibntech.com/robotics-process-automation/

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 25 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022, CMMI-5, and GDPR standards. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive AR efficiency and growth.

Pradip

IBN Technologies LLC

+1 844-644-8440

sales@ibntech.com

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Distribution channels: Business & Economy

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release