41% of Homes in Brazos County Overvalued, Increasing Tax Pressure on Homeowners

O'Connor discusses tat in 2025 41% of homes in Brazos County are being overvalued which leads to increasing tax pressure on homeowners.

HOUSTON, TX, UNITED STATES, June 10, 2025 /EINPresswire.com/ --

Brazos Central Appraisal District (CAD) has released the assessment values for residential and commercial property in 2025. Brazos County, Texas is considered a notable and growing region within the state, growing by 28% in population since 2010. During the 2025 property tax reassessment in Brazos County, approximately 41% of homes were overvalued. This overvaluation suggests that a large percentage of homeowners are at risk of paying higher property taxes than warranted by the actual market value of their homes.

Residential property taxes also grew greatly by 8.0%. This rise is reflective of broader market trends across Texas, where property values have been escalating due to high demand and limited supply. Meanwhile, commercial properties grew by 29% in the same year. The steep increase in commercial property taxes may point to a new development or a growing population.

Brazos Residential Property Values Reach 8%

An analysis of property tax assessments in Brazos County reveals that higher-value, luxury homes experienced the most significant increases, though homes in lower value ranges also saw notable gains. The greatest value increase of 18.2% was seen in homes valued at $1.5 million or more, growing from $1.5 billion to $1.7 billion. Following not too far behind, high-end houses valued between $1 million and $1.5 million increased in value by 12.9% with a 2025 notice market value of $2 billion. The lowest value increase was seen in houses valued at $250k or less by 4.1%. Despite being the lowest value increase of the group, for the value range of the home, a 4.1% increase can greatly impact homeowners.

In Brazos County, all categories of homes per square footage increased in property values, with larger homes experiencing the most significant growth. Homes measuring less than 2,000 square feet saw a slight increase of 6.4%, compared to those over 8,000 square feet, increasing by 16.5%. Although homes measuring between 2,000 and 3,999 square feet are on the smaller end of the spectrum, they experienced the second-highest value increase of 12.7%, rising from $1.6 billion in 2024 to $1.8 billion in 2025.

According to Brazos CAD, houses classified by year built faced major value increases in assessment values, but specifically for newer houses. Recently constructed homes that were built in 2021 and later increased the greatest in value assessment by 31.3%, going from $2.2 billion to $3 billion in the past year. This reflects strong market demand for brand-new or luxury buildings, which often have higher-end features, modern amenities, and are typically in desirable developments. Oddly enough, homes that were built between 2001 and 2020, which also includes newer builds, saw a slight growth of 4.9%. This could indicate a plateau in value for standard suburban homes. In contrast, homes built before 1960 saw a high increase of 9.8% in value. This data tells a nuanced story about how home age influences appraisal value growth in Brazos County, and that growth isn’t linear or purely tied to how new a home is.

Homeowners Face Property Tax Burden as 41% of Homes are Overvalued

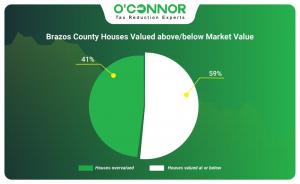

In 2025, Brazos CAD overvalued 41% of homes in the county, while 59% of homes were valued at or below market. This was based on the 2025 reassessed property values and actual home sales prices from 2024. Such a high rate of overvaluation can lead to increased financial burdens on residents, potentially affecting housing affordability and community stability. It also underscores the importance of accurate property assessments and the need for homeowners to be vigilant in reviewing and protesting their property valuations to ensure fair property taxes.

Brazos County appraisal values rose by 8.0%, compared to just a 1.2% increase in home prices across the Houston Metro area from 2024 to 2025. This could imply that Brazos County residents may face higher property taxes due to steep appraisal increases, even though actual market prices aren’t rising quickly. It also might suggest local factors driving up assessments in Brazos County more aggressively than national trends.

Commercial Property Owners Face a 29% Value Increase

An analysis of commercial property tax assessments in Brazos County by value range shows a high overall increase in values, approximately by 29%. For properties valued at $500,000 or less, assessments rose by 20.7%, indicating a high value increase despite this category valuing less than the rest. Properties worth over $5 million experienced a significant increase of 30.2%, growing from $5 billion to $7 billion in the past year alone. The second-greatest growth was seen in commercial property valued between $500,000 to $1 million with 28.5%.

For the 2025 tax year, Brazos CAD increased the market values for all categories of commercial properties. The largest increases were seen in warehouses with 45.8% and retail with 39.9%. The market value for warehouses grew from $724 million to $1.1 billion, and retail grew from $729 million to $1 billion from 2024 to 2025. This particular value growth in warehouses and retail suggests that these sectors are booming due to expanding logistics, e-commerce, and consumer activity. Other notable value increases include 30.7% in hotels and 30.3% in apartments.

For 2025, Brazos CAD raised commercial property assessments across all construction years, with older properties seeing especially larger increases compared to newer buildings, with one exception. This trend contrasts with the county’s residential property values for the same year. This suggests a revaluation that might reflect changes in the market or improvements in older properties’ perceived worth. Properties built in 2021 or later experienced the largest value growth of 76.5% and it was the only newer property built to experience a high value increase. The second-highest value increase of 55.1% was seen in commercial properties built before 1960.

Growing Gap Between Appraised Property Values and Market Performance

The 2025 commercial property tax reassessment by Brazos CAD stands in sharp contrast to findings from Wall Street firm Green Street Real Estate Advisors. While Green Street reports a 21% decline in commercial property values since their 2022 peak, Brazos CAD shows an increase of more than 29% over the past year. Property owners can use this discrepancy to become a focal point of appeals.

Apartment Owners Hit with 30.3% Spike in Assessed Property Values

The graph reveals a mixed correlation between an apartment’s construction year and the percentage increase in property tax assessments in Brazos County for 2025. Apartments built in 2021 or later saw the second-highest increase, with assessments rising 84.2% from $226 million to $417 million. Older apartments, such as those built between 1961 and 1980, also saw a high increase of 41.3%. Surprisingly, the lowest value increase, although still a high number, was seen in apartments built between 2001 and 2020 by 22.3%. The highest increase of 239.6% belongs to apartments without a construction date.

Apartment owners in Brazos County faced a significant property tax increase in 2025, as the CAD raised the taxable value by 30.3% overall, from $4 billion to $5.1 billion. Three apartment subtypes were assessed, and the value increases are as follows: apartment student housing with 31.3%, standard apartments with 30.1%, and rental apartments with 9.9%.

Older Office Buildings Are Raised Greatly in Value

Per Brazos CAD, tax assessments for office buildings in 2025 have increased across all construction years with no clear trend. The highest increase, 56.7%, affects office buildings built between 1961 and 1980, growing from $76 million to $119 million. Following closely behind are new office buildings built in 2021 and later with a 56.2% increase, and a 2025 notice market value of $64 million. Overall, property owners of office buildings in Brazos County witnessed significant value increases for 2025.

Brazos County classifies office properties into two subtypes: general office and medical office buildings. In 2025, property tax assessments increased for both categories. General office buildings experienced the most significant surge, with values rising by 33.0%, while medical office buildings saw a more modest 12.5% increase. Overall, the total market value of office properties jumped from $1.2 billion to $2 billion over the past year.

Retail Owners Collectively Experience 39.9% Value Increase

Retail property tax assessments in Brazos County increased across the board, regardless of construction year. Retail properties built before 1960 saw a significant rise of 57.2%, rising from $13 million to $20 million. However, retail property built between 2001 and 2020 experienced the largest increase of 66.8% with a notice market value of $35 million in 2025. Retail property with no construction date saw a decline in value assessments by 33.5%, dropping from $17 million to $11 million.

Property tax assessments increased across all retail property subtypes in Brazos County in 2025. Three retail property subtypes were assessed in value: retail stores, community shopping centers, and neighborhood strips. The highest value increase of the three was witnessed in retail stores, growing by 65.3%, followed by neighborhood strips with 42.3%, and community shopping centers with 34.5%.

Warehouse Tax Assessments Reach Outstanding Heights in 2025

In Brazos County, all warehouse categories per year built increased in assessment values for 2025, except for one category. The highest value growth was seen in newer warehouses built in 2021 and later with 59.4%, showcasing a growth of $103 million in 2024 to $164 million in 2025. Nearly matching, older warehouses built between 1961 and 1980 also witnessed a high increase of 57.1%. The only warehouse category not to experience an increase in value were those built before 1960 with 0% growth.

Brazos CAD assessed the market values of two warehouse categories: mini and standard warehouses. Standard warehouses increased the most out of the two by 46.3% and mini warehouses increased by 44.4%. The total market value grew from $724 million in 2024 to $1.1 billion in 2025.

Brazos County Faces Steep Property Valuations

The 2025 reassessment revealed that approximately 41% of homes were overvalued, placing many homeowners at risk of paying more in property taxes than their properties are truly worth. Residential property taxes rose by 8.0%, aligning with statewide trends driven by high demand and limited housing supply. At the same time, commercial property values surged by 29%, likely reflecting ongoing development and the county’s expanding population. These trends highlight the mounting financial pressure on property owners and underscore the importance of accurate assessments in fast-growing regions.

Appeal Your Property Taxes Annually

Brazos County, Texas property owners have the legal right to appeal their property tax assessments if they believe their property’s valuation is inaccurate or excessive. This right applies to all property types, whether residential, commercial, or industrial. The appeals process provides an opportunity for owners to present evidence, such as comparable sales data, income information, or repair estimates, to demonstrate that the assessed value is higher than the true market value.

Filing a protest independently or partnering with a qualified property tax consulting firm can be highly effective. In fact, a significant percentage of appeals result in lowered assessments, leading to reduced tax liabilities. Working with experienced consultants can streamline the process and improve the chances of success by leveraging professional market analysis and appraisal techniques.

O’Connor, one of the nation’s largest property tax consulting firms, has been helping property owners reduce their tax burdens for over 50 years. With a focus on cost-effective and results-driven methods, O’Connor represents thousands of clients annually, ensuring they pay no more than their fair share of property taxes. In 2024 alone, thousands of our clients saved over $190 million collectively.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Texas, Illinois, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Distribution channels: Banking, Finance & Investment Industry, Building & Construction Industry, Business & Economy, Consumer Goods, Real Estate & Property Management

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release