DeKalb Homes Could be Overvalued as High as 6.7%

O'Connor discusses the 2025 value assessments for Dekalb County, Georgia.

ATLANTA, GA, UNITED STATES, June 18, 2025 /EINPresswire.com/ --

The Atlanta area is on a historic ascension, with each county seeing an influx of people and prosperity. Boasting some of the highest diversity and culture in the United States, the Atlanta area is quickly becoming a destination place to live. Of all the suburban counties, DeKalb County may be the most evocative of Atlanta. Young, vibrant, and with a reputation for food and music, DeKalb County is becoming an in-demand place to live and work.

The downside of this popularity is that demand for properties brings higher valuations and taxes. The Atlanta area is becoming infamous for its soaring taxes, and while somewhat insulated, DeKalb County is seeing the same boom coming to their communities. While there are pros and cons to this change in fortunes, higher taxes can mean traditional and working families have a tougher time staying in their homes.

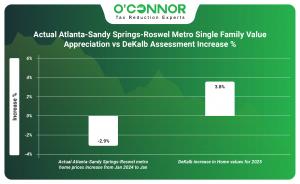

DeKalb Residential Properties Grow 3.8%

Single-family homes across DeKalb County are worth a combined taxable value of $76.89 billion, according to the DeKalb Board of Assessors. Residential property showed a jump in value of 3.8% in 2025. Homes worth $250,000 to $500,000 accounted for $29.58 billion, while those worth between $500,000 and $750,000 were valued at $18.57 billion. These homes saw their value grow by 2.4% and 4.9%, respectively. Owners of homes worth less than $250,000 got some relief, as their taxable value fell by 0.7%. High-end and luxury homes experienced the highest increase in their values, with homes worth over $1.5 million going up by 9.0%.

Before beginning the slow transition to a trendy suburb, DeKalb County had a reputation as a working-class area. This is reflected in homes, with the majority of residential value being in homes of modest size. Homes under 2,000 square feet contributed $30.44 billion in value, while those between 2,000 and 3,999 square feet brought the most at $40.73 billion. Homes of these measurements both grew their value at a rate of 3.8%. Homes between 4,000 and 5,999 added the most value by a percentage of 3.9%. Luxury homes did not offer much raw value, but did increase in taxable value by 3.7%.

DeKalb does not have a history of being a boom-bust area and has grown evenly over time. Like home size, this can be illustrated in the value of homes broken down by age. 29% of all residential value was from homes built before 1960. This was followed by homes constructed between 1961 and 1980 with 27% of the value. This pattern of descent was followed until reaching new construction, which provided 0%. This also illustrates that DeKalb County has a lot of homes that have stayed in family hands for decades.

DeKalb County Shows Signs of Overvaluation

When the Dekalb Board of Assessors studied home sales in comparison to the tax valuations for similar properties, they discovered some discrepancies. The main takeaway was that an estimated 38% of single-family homes were overvalued, compared to 62% that were undervalued or within the margin of error. While not as egregious as some surrounding counties, it is an illustration that assessors can make mistakes, leaving taxpayers holding the bag with additional taxes.

If the DeKalb County Board of Assessors is to be believed, then residential properties across the county added 3.8% to their fair market value. This is called into question by a study from Georgia MLS Real Estate Services, a research firm for Atlanta realtors. According to their exhaustive research into home sales, the value of the average DeKalb County home dropped by 2.9%. If this is true, then most residents are being overvalued by 6.7%. This means homes are taxed on a value higher than they could be sold for on the open market. This is the textbook reason to explore a property tax appeal.

Commercial Properties Rise 2.1%

The trend of steady gains continues when commercial properties are examined. Valued at a total of $33.18 billion, DeKalb County businesses saw a rise of 2.1%. When broken down by the worth of the property, it can be seen that the biggest holder of value is commercial properties worth over $5 million. At a value of $27.64 billion, these behemoths steer the economy of the county. While the big companies added 1.3% more in value, smaller companies saw bigger jumps. Commercial properties worth between $500,000 and $1 million managed to net an increase of 9.1%, while those worth less than $500,000 added 8.0%.

With a reputation as a suburb, it is little wonder that DeKalb apartments top commercial property with $16.15 billion. Apartments did lose 2% of their assessed value, translating into roughly a drop of $330 million. While apartments were the clear No. 1, offices and warehouses battled it out for the No. 2 spot, with both valued at over $5 billion. Warehouses saw the biggest gain in taxable value, while hotels saw the largest percentage increase with a staggering 85%. Raw land jumped up by 10.8% or $123.68 million. It can be seen that the total taxable value increase of 2.1% would have been much higher if not for the step back of apartments.

Like residential homes, commercial property value is pretty even across the ages of construction. 34% of property value was built between 1961 and 1980, while 33% was built from 1981 to 2000. 22% of commercial value was also constructed between 2001 and 2020. Of these timeframes, only those with an age of construction between 1981 and 2000 saw a loss, albeit a small one of 0.1%. The oldest construction type grew by 11.9%, while new construction got a bump of 11.1%. New construction already accounts for 2% of all commercial value.

DeKalb Value Compared to the Nation

Property tax appeals are used to gain clarity in uncertain situations, and it is starting to look like DeKalb County is one of them. A recent study by Green Street, a large real estate firm, showed that commercial property across the United States is down in value by 15%. This is thanks to a litany of economic factors, including interest rates, difficulty buying, and investments outside of commercial property being more attractive. This is in contrast to the taxable values put forward by the DeKalb Board of Assessors, which claims a growth of 2.1%. While Green Street’s numbers reflect the nation as a whole and not Georgia by its lonesome, this does raise questions about the true value of assessed property.

Apartments Lost Value in 2025

While head-and-shoulders above any other commercial property type, apartments saw their assessed value slashed by 2% in 2025. By looking at apartments by age, it seems that the catalyst for this is a drop in the value of traditionally stalwart age ranges. Apartments built between 1961 and 2000 saw their value decrease by 3.7%. As these properties account for 70% of value, it is easy to see why overall apartment value dropped. Those built between 2001 and 2020 saw a small drop of 0.2%. A 29% increase in new construction and a 22.5% hike in older buildings were able to somewhat balance the scales, but their share of value is only 5% of the whole.

When divided up into subtypes, it is easier to finger the culprit for the fall in value. Low-rise apartments make up the largest share of value with $14.46 billion. In 205, low-rise apartments saw a loss of 2.9% taxable value. This comes out to a negative of $430.86 million. This loss easily overcame a 3.7% gain for generic apartments and a 6.5% jump for high-rise apartments. This could indicate a shift from traditional fare to high-rise apartments in the future.

Offices Grow Across the Board

While apartment totals were in the red, all other commercial property was on the rise in DeKalb County. Offices have traditionally been the second-most valuable commercial property and managed to keep that spot in 2025. Going by age of construction, offices have a similar pattern to apartments, with the largest block of value being created between 1981 and 2000. While this also suffered a drop of 3.4%, it was countered by an increase of 5.8% by offices built between 1961 and 1980. Those built from 2001 to 2020 edged up by 1.5%. There was little growth in new construction, but it appears that there are plenty of older properties to serve the needs of DeKalb County.

Offices are divided up into three subtypes. High-rise apartments are the biggest block of value by a wide margin but suffered a drop of 1.8%. This was countered by a growth rate of 8.2% for medical offices and an increase of 4.3% for low-rise offices. Time will tell if this change was simply a one-year fluke or if things are trending more towards low-rise offices in the future.

Retail Rises 7% in 2025

Only warehouses added more taxable value than retail in 2025, as stores of various kinds added 7% to their worth. Retail follows a similar pattern to residential and other commercial properties when it comes to date of construction. 36% of all retail value was built between 1961 and 1980, while also adding 9.3% in 2025. Construction from 1981 to 2000 added 9.5%, surpassing those built between 2001 and 2020. New construction was the only time range to see a loss, as it suffered a drop of 1.5%.

While DeKalb County’s retail properties are divided into four subtypes, it is shopping centers that rule the roost. Combining over $3 billion in value, shopping centers make up three-thirds of all value. Neighborhood shopping centers took the No. 1 spot, while also adding 6.3% in taxable value. Community shopping centers were right behind and added a solid 7.8%. Single-tenant retailers increased the highest with regard to percentage, with 13.9%.

Warehouses Add More Value

Warehouses are only behind apartments and offices in total taxable value and were able to close the gap somewhat in 2025 with an increase of 6.1%. Unlike other commercial properties, the majority of warehouses were constructed between 1961 and 1980, for a combined total of 52%. Those built between 1981 and 2020 carry 29% of all value, while also growing 4.9% in 2025. All warehouses experienced an increase in taxable value, with the exception of the oldest ones. The older warehouses saw a small drop of 0.2%.

While warehouses are classified by many different types, generic warehouses easily dominate the others with $4.54 billion in value. Mini warehouses follow behind at a very distant second, with $957.18 million. Office warehouses had $151.15 million in total value, but also added 19.8% in 2025. Every subtype gained at least 5% in taxable value in 2025, with the exception of metallic warehouses, which only managed 0.5%.

DeKalb County Roundup

DeKalb County is in a state of transition. While some communities are becoming hot housing markets and home to trendy businesses, others are closer to the working-class roots of the area. As Atlanta continues to become one of the most desirable cities to live in America, the demand for all land in DeKalb County is only going to skyrocket. While this is good news for sellers, it is bad news for those that wish to keep their properties.

Whether you are a traditional homeowner fighting rising taxes and gentrification, or a new resident that is trying to get a fair deal, the only way to protect yourself is with a property tax protest. Georgia has seen property tax reform in recent years, making things more difficult for protestors. There is a property tax freeze that will trigger if an appeal is successful, keeping the valuation amount the same for three years after, no matter the changes in the marketplace. In a fast-growing place like DeKalb County, this can mean a great deal.

Join forces with O’Connor and increase your chance at landing a property tax freeze. With more evidence required than ever, it always helps to have the guidance of a firm with over 50 years in the property tax game. As one of the largest firms in the nation, O’Connor has the resources needed to take on the DeKalb Board of Assessors and come on top. It is always free to enroll to have your taxes protested annually, and you will only be charged a fee if you win your appeal.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Georgia, Texas, Illinois, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Distribution channels: Banking, Finance & Investment Industry, Building & Construction Industry, Business & Economy, Consumer Goods, Real Estate & Property Management

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release